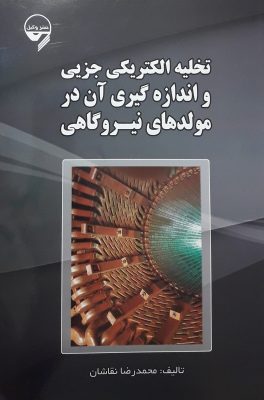

تست تخلیه جزئی به روش الکتریکال

تست استقامت ولتاژ عایقی (Hipot)

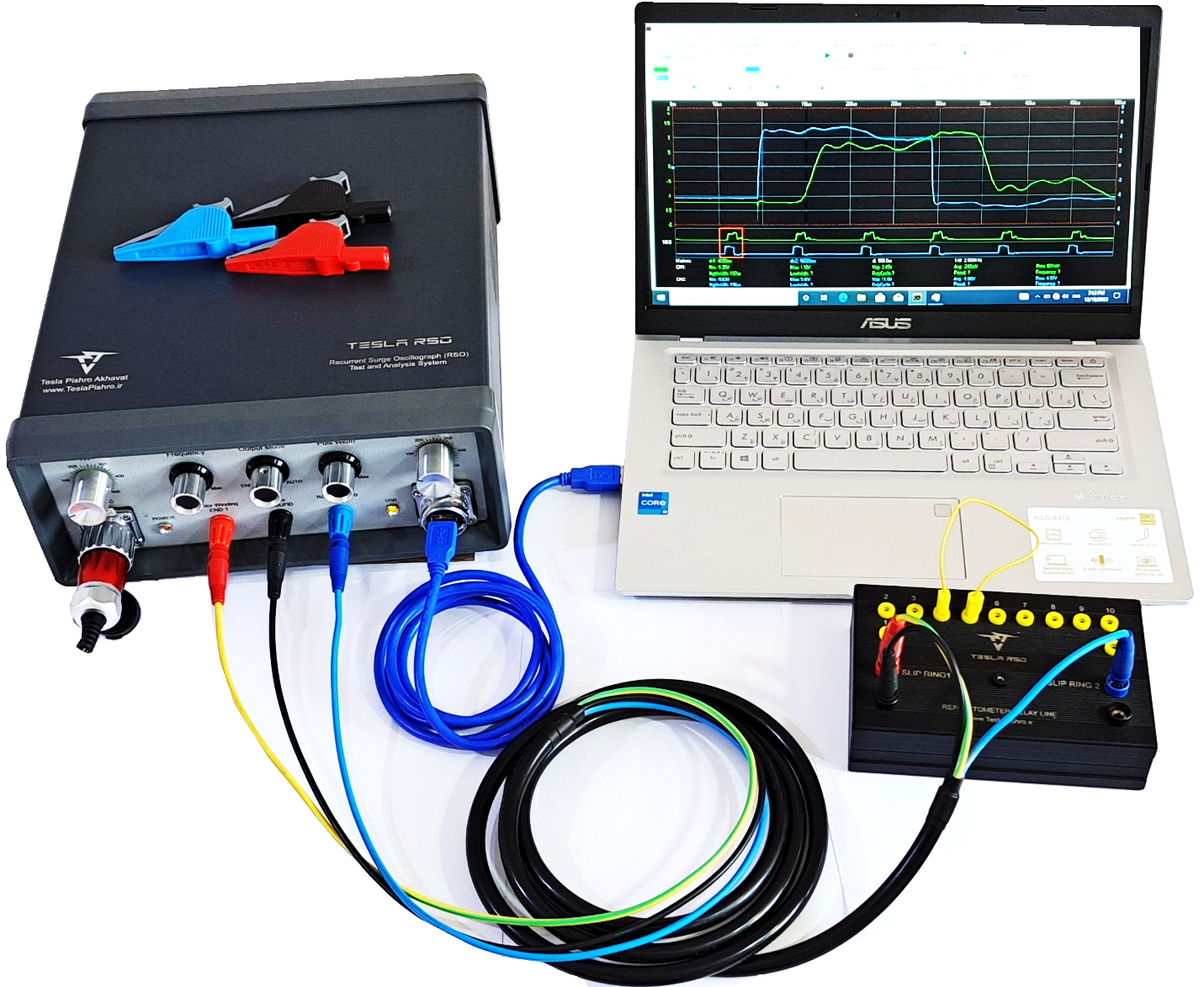

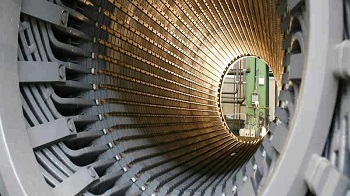

تست اتصال حلقه و بدنه روتور (RSO)

مکانیابی آلتراسونیک عیوب

تست تانژانت دلتا

خدمات آموزشی

چرا ما ؟

- تحت حمایت پارک علم و فناوری و مورد تائید پژوهشگاه نیرو

- تنها شرکت تولیدکننده خازنهای کوپلاژ تخلیه جزیی در خاورمیانه TESLA CC

- تنها شرکت سازنده دستگاه تست اتصال حلقه روتور (RSO)ژنراتورهای نیروگاهی

- تنها شرکت سازنده دستگاه تست آلتراسونیک سرکابل فشارقوی و مقره (TESLA UT)

- تجربه بیش از ۲۰۰ تست الکتریک در بخشهای مختلف تولید انتقال و توزیع صنعت برق

- بیش از 30 مقاله ثبتشده توسط کارشناسان و متخصصان شرکت فقط در حوزه تخلیه جزئی

- مورد تائید شرکت تولید نیروی برق حرارتی در زمینه خدمات تست تخلیه جزیی نیروگاههای کشور

- با افتخار تمامی مراحل تولید محصولات شامل طراحی، ساخت، مونتاژ و کالیبراسیون توسط متخصصان داخل شرکت صورت میگیرد

اخبار و رویدادهای اخیر

مصاحبه شبکه نسیم با مدیر عامل شرکت تسلاپیشرو اخوات

“تقدیر از توانمدنی های شرکت تسلا پیشرو اخوات توسط دکتر فرهاد رهبر ریاست محترم دانشگاه آزاد اسلامی در همایش مخترعان، مبتکران و اساتید برتر کشور”